ABSTRACT OF GROUP INSURANCE (UPDATED)

https://govtemployeematters.com

THE PUNJAB GOVERNMENT EMPLOYEES WELFARE FUND ORDINANCE, 1969

(W.P. Ordinance I of 1969)

C O N T E N T S

SECTION HEADING

- Short title, application and commencement.

- Definitions.

- Welfare Fund.

- Constitution and powers of the Welfare Boards.

- Arrangement with insurance company.

- Payment of contributions.

- Powers to make rules.

SCHEDULE

[18 March 1969]

An Ordinance to establish a Welfare Fund for the relief and security of the employees of the Punjab Government and their families.

Preamble.– WHEREAS it is expedient to establish Welfare Fund for the relief and security of the employees of the [Punjab] Government and their families;

AND WHEREAS the Provincial Assembly of West Pakistan is not in session and the Governor of West Pakistan is satisfied that circumstances exist which render immediate legislation necessary;

NOW, THEREFORE, in exercise of the powers conferred on him by clause (1) of Article 79 of the Constitution, the Governor of West Pakistan is pleased to make and promulgate the following Ordinance:-

- Short title, application and commencement.–

(1) This Ordinance may be called the [Punjab] Government Employees Welfare Fund Ordinance, 1969.

(2) It shall apply to all Government servants, as hereinafter defined provided that Government may, by notification, exempt any class of Government servants from the operation of this Ordinance.

(3) It shall come into force on such date as Government may, by notification, appoint in this behalf.

- Definitions.– In this Ordinance, unless the context otherwise requires, the following expressions shall have the meanings hereby respectively assigned to them:-

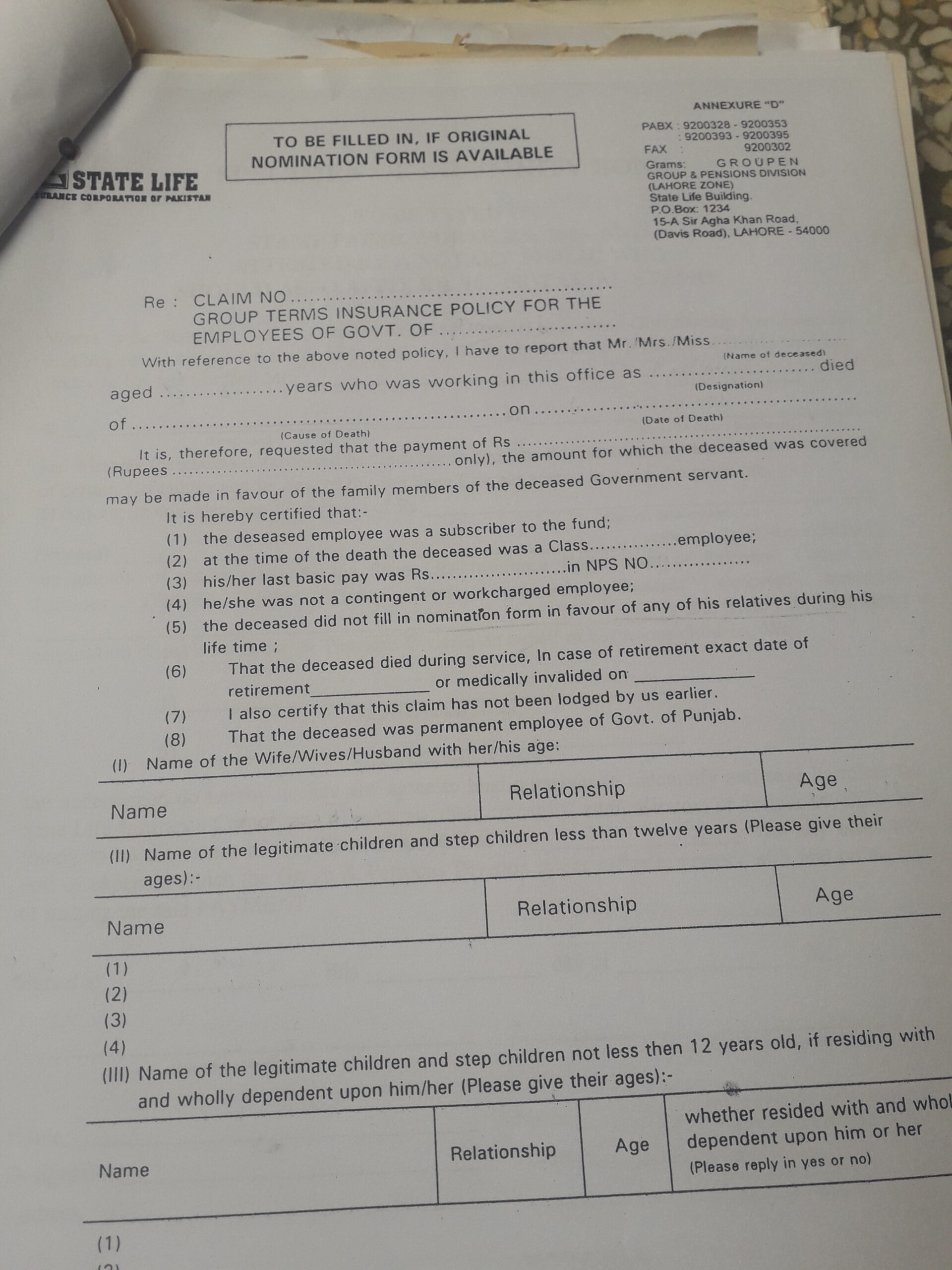

(a) “family” in relation to a Government servant means his or her–

(i) wife or wives or husband, as the case may be;

(ii) legitimate children and step children less than twelve years old;

(iii) legitimate children and step children not less than twelve years old, if residing with and wholly dependent upon him or her; and

(iv) parents, sisters and minor brothers, if residing with and wholly dependant upon him or her;

https://govtemployeematters.com

(b) “gazetted Government servant” means the Government servant holding a post in basic scale BS 16 or above;

(c) “Government” means the Provincial Government of the Punjab

[(d) “Government servant” means a person, not being a member of an all Pakistan service or a contract employee of the Government,–

(i) who is a member of civil service of the Province;

(ii) who holds a civil post in connection with the affairs of the Province; or

(iii) who has retired as a member of civil service of the Province after completing the age of superannuation and has not attained the age of sixty five years;

(e) “non-gazetted Government servant” means a Government servant other than gazetted Government servant’

(f) “prescribed” means prescribed by rules made under this Ordinance;

(g) “rules” means rules made under this Ordinance;

(h) “Welfare Fund” means the Welfare Fund established under this Ordinance.

- Welfare Fund.–

(1) There shall be established a fund to be called the Punjab] Employees Welfare Fund.

(2) To the credit of the Fund shall be placed–

(a) all contributions received under section 6 from Government servants;

(b) the contributions made to the Fund by Government, the Government Servants Benevolent Fund or the Police Welfare Fund; and

(c) any interest or profit accruing on such contributions.

(3) The Welfare Fund shall be divided into two parts: Part I for gazetted Government servants and Part II for non-gazetted Government servants and each such part shall be maintained and administered separately in accordance

with the provisions of this Ordinance.

(4) The contributions from gazetted Government servants received under section 6 shall be credited into Part I of the Welfare Fund and the contributions received from non-gazetted Government servants shall be credited into Part II of the Fund.

(5) The moneys credited into the Welfare Fund shall be kept in such bank or banks as may be prescribed.

(6) The Welfare Fund shall be utilized for meeting the expenses on arrangements to be made with an insurance company or other insurer for the insurance of Government servants.

(7) Any sums remaining in the Welfare Fund after defraying the expenses referred to in sub-section (6) may be utilized for such benefits to Government servants and their families as may be prescribed.

- Constitution and powers of the Welfare Boards.–

(1) The Government shall constitute the following Welfare Boards:-

(a) the Provincial Welfare Board (Gazetted); and

(b) the Provincial Welfare Board (Non-Gazetted).]

(2) Part I of the Welfare Fund shall vest in the Provincial Welfare Board (Gazetted), and Part II of the Welfare Fund shall vest in the Provincial Welfare Board (Non-Gazetted), and each of the said Boards shall administer the part of the Welfare Fund vesting in it in such manner as may be prescribed.

(3) Subject to such rules as may be made in this behalf and to such directions as may be issued by Government, the Provincial Welfare Boards–

(a) shall from time to time, arrange for the insurance of the Government servants with which they are concerned in the sums specified in the Schedule with such insurance company or other insurer as it deems fit;

https://govtemployeematters.com

(b) shall have the power to sanction expenditure connected with the administration and management of that part of the Welfare Fund which vests in them; and

(c) may do or cause to be done all the things ancillary or incidental to any of the aforesaid powers or to the purposes of the Welfare Fund.

- Arrangement with insurance company.–

(1) The arrangement to be made with an insurance company or other insurer under clause (a) of sub-section (3) of section 4 shall be to the effect that on the death caused due to any reason other than war, invasion or civil war], of a Government servant of the class specified in column 1 of the Schedule, the sum specified against that class of Government servant in column 2 of the Schedule be paid–

(a) to such member or members of his family as he may have nominated for the purpose, in full or in the shares specified by him at the time of making the nomination;

(b) where no valid nomination by the Government servant exists at the time of his death, the sum assured shall be paid to his family, and in the absence of a family, to his surviving relatives, if any, in the manner and in the shares in which the gratuity of a deceased Government servant is payable under the Pension Rules, as in force for the time being and

(c) in the absence of the persons referred to in clauses (a) and (b), to his heirs.]

[(2) Where death of a Government servant is caused as a result of war, invasion or civil war, the sum, as specified in column 2 of the Schedule shall be paid by Government in the same manner as is provided in clauses (a) and (b) of subsection

- Payment of contributions.–

(1) A Government servant, not being a retired Government servant, shall pay as his

contribution in the Welfare Fund the sum of money as may be prescribed and the Amount of his contribution shall, as far as possible, be deducted at source from his pay and the same shall be credited to the Welfare Fund.

(2) Where the contribution cannot for any reason be deducted from the pay of the Government servant, he shall remit to the prescribed officer, the amount of the contribution payable by him.

(3) Any contribution remaining unpaid due to inadvertence or negligence of the Government servant or otherwise shall be recoverable from him together with interest.

- Powers to make rules.– Government may make rules for the purposes of giving effect to all or any of the provisions of this Ordinance.

SCHEDULE

[SEE SECTIONS 4 AND 5]

The sums in which various classes of Government servants are to be insured–

Class of Government Servant Sum insured

BS 1-4 150000

BS 5-10 175000

BS 11-15 300000

BS 16 450000

BS 17 600000

BS 18 875000

BS 19 1050000

BS 20 & above 1250000

https://govtemployeematters.com

Notification No. Legis.3(XIV)96 Dated 06-11-1996 w.e.f. 06-11-1996

Sub: AMENDMENT IN SECTION 5 OF ORD. 1 OF 1969:

According to this amendment if a government servant dies without having a valid nomination for Group Insurance and without being survived any family member or surviving relative the amount of his/her Group Insurance will be paid to his legal heir i.e, the persons in whose favor the Succession Certificate is issued by the competent court of law.

https://govtemployeematters.com

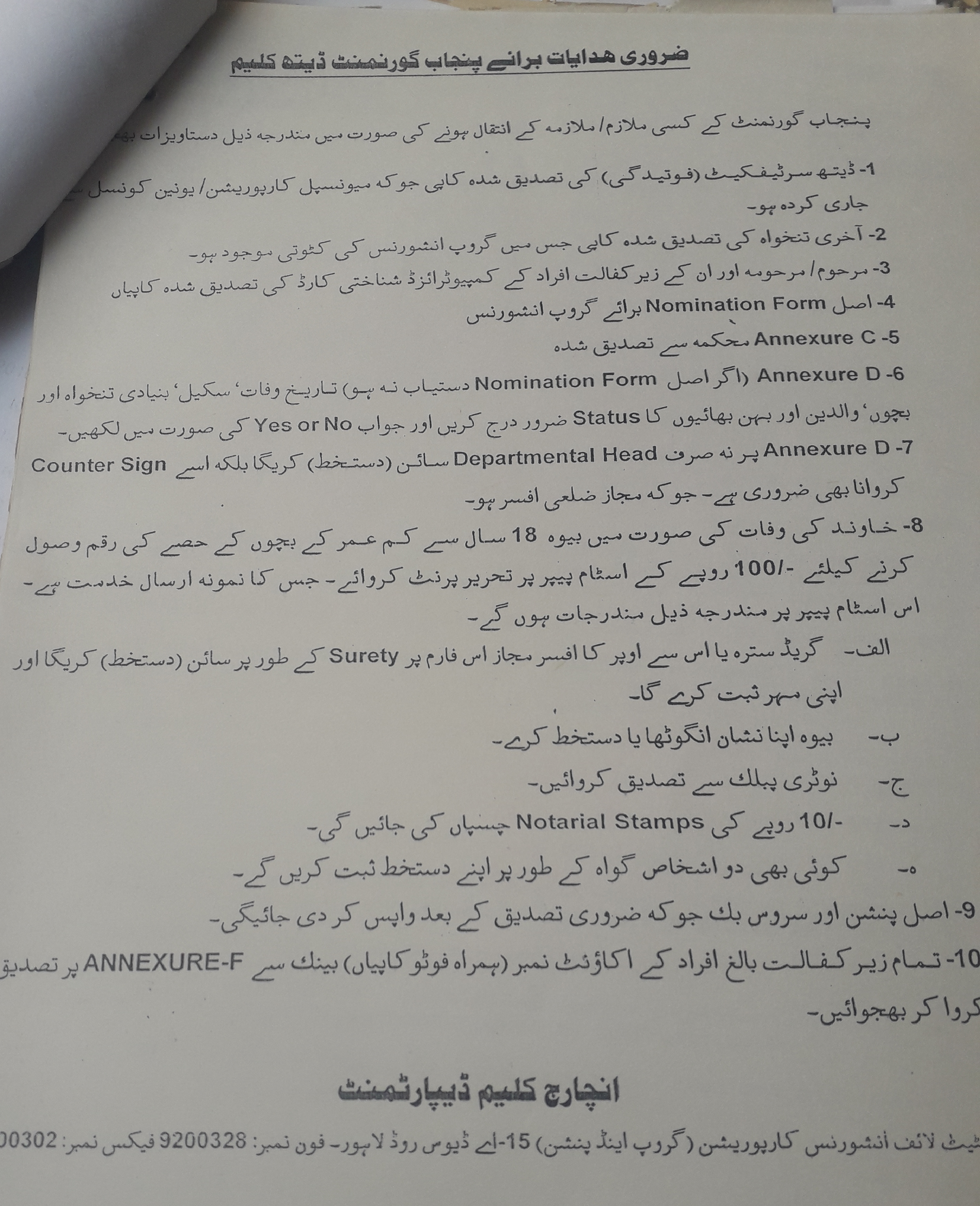

LIST OF DOCUMENTS REQUIRED FOR SUBMISSION OF DEATH CLAIM OF GROUP INSURANCE

1) Death Certificate by NADRA

2) Obituary Notice

3) Computerized Pay Slip

4) Request of the widow

5) List of Family Members

6) CNIC of deceased and other family members

7) Copy of Service Book

8) Non Remarriage certificate on judicial paper of Rs.20/-

9) Indemnity Bond

10) Order for current Pay Scale

10) Request of Widow

11) Original Nomination Paper if available

https://govtemployeematters.com

FAMILY DEFINITION AS PER GROUP INSURANCE RULES

| (a) In the case of male employee, the wife or wives and in the case of a female employee, the husband of the employee, and |

| 2(a) “Family” in relation to a government servants means his or her:- |

| i) Wife or wives or husband, as the case may be; |

| ii) Legitimate children and step children less than twelve years old; |

| iii) Legitimate children and step children not less than twelve years old, if residing with wholly dependant upon him or her; and |

| iv) Parents, sisters and minor brothers, if residing with and wholly dependant upon him or her” |

| (a) If a Government Servant dies during service within 15-years after his retirement, his widow shall be entitled till her death to a monthly grant at the rate already prescribed in this behalf. |

| (b) In case of death of an invalid retired Government servant, the monthly grant may be transferred in the name of his widow for rest of her life. |

| (c) In case of death of a widow, the monthly grant may be transferred in the name of the dependant minor family member upto the age of maturity.” |

| This shall be applicable to those servants as well who are already receiving the monthly grant”. |

GROUP INSURANCE MONTHLY DEDUCTION RATES AND AMOUNT INSURED IN CONSOLIDATED FORM

| BS/Grade | 01-07-02

|

01-07-07

|

01-07-12

|

01-07-16 | 01-07-20 | |||||

| Monthly Ded. | Sum Assured | Monthly Ded. | Sum Assured | Monthly Ded. | Sum Assured | Monthly Ded. | Sum Assured | Monthly Ded. | Sum Assured | |

| 1-4 | 37.5 | 120000 | 60 | 150000 | 55 | 150000 | 54 | 150000 | 67 | 150000 |

| 5-10 | 43.75 | 140000 | 70 | 175000 | 64 | 175000 | 63 | 175000 | 79 | 175000 |

| 16 | 75 | 240000 | 120 | 300000 | 110 | 300000 | 107 | 300000 | 135 | 300000 |

| 17 | 112.5 | 360000 | 180 | 450000 | 165 | 450000 | 161 | 450000 | 202 | 450000 |

| 18 | 150 | 480000 | 240 | 600000 | 221 | 600000 | 215 | 600000 | 269 | 600000 |

| 19 | 218.75 | 700000 | 349 | 875000 | 322 | 875000 | 313 | 875000 | 392 | 875000 |

| 20 | 262.5 | 840000 | 419 | 1050000 | 386 | 1050000 | 375 | 1050000 | 471 | 1050000 |

| State Life vide letter dated 05-10-2002 | State Life vide letter dated 07-07-2012

|

State Life vide letter dated 07-07-2012

|

Postal Life vide letter dated 20-7-2016 | State Life vide letter dated 16-09-2020

|

||||||

https://govtemployeematters.com

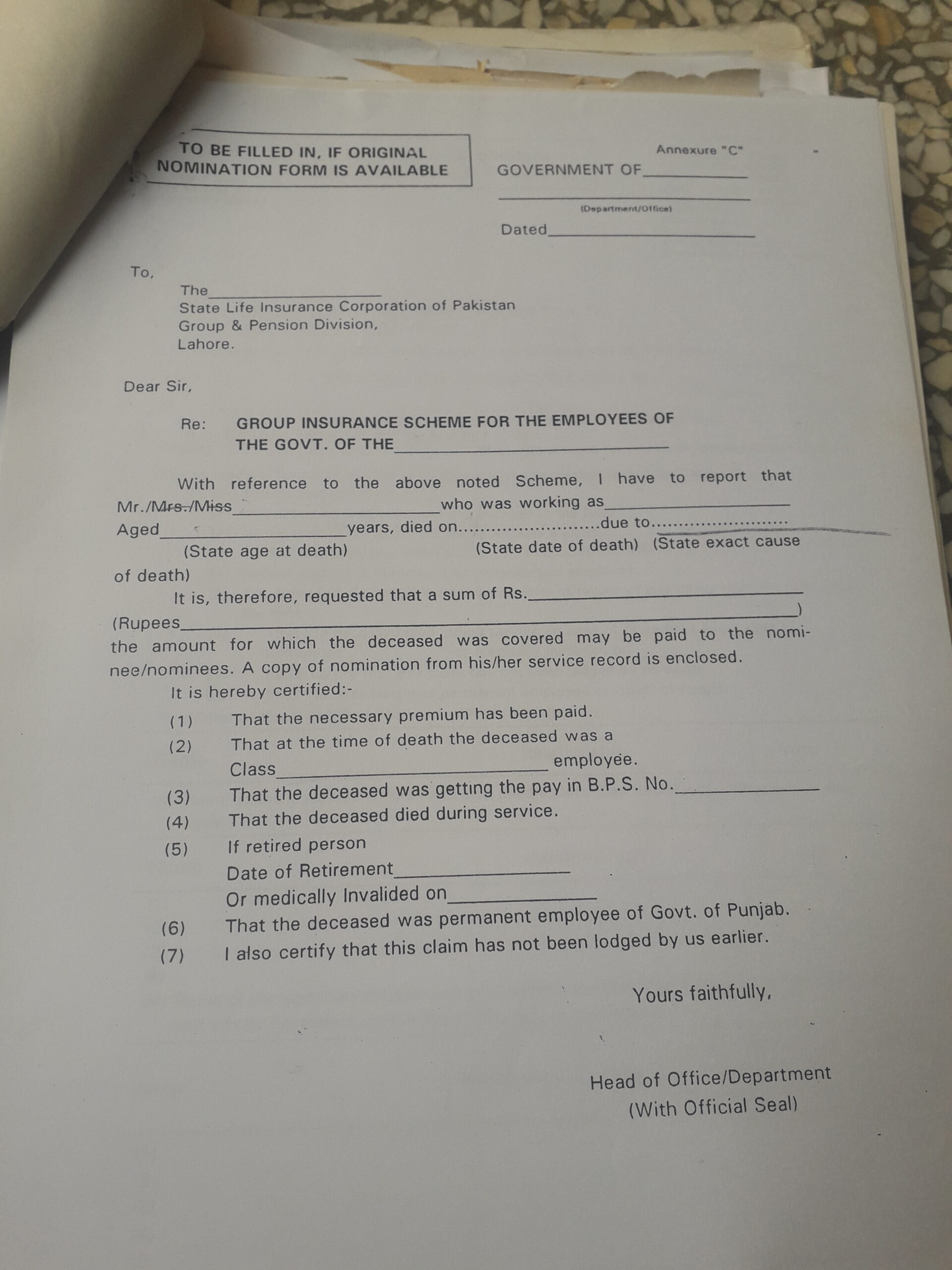

To,

The Deputy Manager Claims

State Life Ins. Corp. of Pakistan,

GROUP & PENSION DIVISION,

15-A, Sir Agha Khan Some Road

LAHORE

https://govtemployeematters.com

Sub: GROUP INSURANCE CASE OF MR. —————TO HIS FAMILY:

The official Mr. ———– S/O died while working as ——— (BS- ), on Regular basis in the office of ——————, on ————-. (May Allah rest his soul in peace).

He was a regular employee and Group Insurance was being deducted regularly from his pay. The following documents are enclosed herewith.

1) Death Certificate by NADRA

2) Obituary Notice

3) Computerized Pay Slip

4) Request of the widow

5) List of Family Members

6) CNIC of deceased and other family members

7) Copy of Service Book

8) Non Remarriage certificate on judicial paper of Rs.20/-

9) Indemnity Bond

10) Order for current Pay Scale

10) Request of Widow

11) Original Nomination Paper if available

It is therefore requested that his case for Death Claim may kindly be processed.

OFFICE STAMP

https://govtemployeematters.com

INDEMNITY BOND

Whereas the State Life had required the claimant (Mother) to produce Guardianship Certificate for enabling her to collect the shares of her minor children on account of proceeds of Group Insurance Policy of her late husband Mr. ————– S/O ————— as ———– at office of ————————————– and whereas the claimant expressed her inability to produce the Guardianship Certificate on account of certain difficulties and in view of this the State Life has agreed to make the payment. Therefore, in consideration of Payment of Rs……………..(Rupees…………………………………..……………………………Only) without the certificate the amount of claim made by the State Life Insurance Corporation of Pakistan, Group and Pension Division under Group Term Assurance Contract executed between ————— and State Life Insurance Corporation of Pakistan Group & Pension Division on behalf of her minor children. We:-

- ————————–

(Name of Claimant (Mother)

- ==============================

(Name of the Surety Class-I Officer)

the undersigned do hereby declare and agree to bind ourselves to indemnify and save harmless the State Life Insurance Corporation of Pakistan, their executors, administrators or assigns severely and jointly to be the extent of the aforesaid amount of Rs. …………. with any other loss, cost of expenses which the Group & Pension Division might suffer in respect with and on account of making the said PAYMENT.

Signed at ________________this ________________ day of ______________2

- _________________________ 2. __________________________

(Signature of Surety) (Signature of Claimant (Mother)

Name: ——————— Name: =============

Designation =============== Address: =================

—————————————– P.O.============== District =======

WITNESS WITNESS

Signature: ________________ Signature: __________________

Name: ==================== Name: =================

Designation: ============== Designation: ==================

Address: O/O ============= Address: O/O ————————-i

https://govtemployeematters.com